Search

[{{{type}}}] {{{reason}}}

{{/data.error.root_cause}}{{{_source.title}}} {{#_source.showPrice}} {{{_source.displayPrice}}} {{/_source.showPrice}}

{{#_source.showLink}} {{/_source.showLink}} {{#_source.showDate}}{{{_source.displayDate}}}

{{/_source.showDate}}{{{_source.description}}}

{{#_source.additionalInfo}}{{#_source.additionalFields}} {{#title}} {{{label}}}: {{{title}}} {{/title}} {{/_source.additionalFields}}

{{/_source.additionalInfo}}The Chronicles of Grant County

This column will feature items that relate somehow to Grant County - the name of a street in the case of the first one, and maybe other streets, or the name of a building or whatever catches the fancy of the contributor, Richard Donough. Readers are encouraged to send him topics of interest to them, so he can do the research and write an article.

- Category: The Chronicles of Grant County

The Chronicles Of Grant County

New Federal Reporting Requirements

No Longer To Be Enforced

Part Six

Scott Bessent is the Secretary of the Treasury of the United States. (The photograph was provided courtesy of the United States Department of the Treasury.)

Scott Bessent is the Secretary of the Treasury of the United States. (The photograph was provided courtesy of the United States Department of the Treasury.)

[Editor's Note: The federal government has been going back and forth on this for months. This seems to finally be the end of it! All of us small businesses are happy!]

Forget about it.

That is, in essence, what the United States Department of the Treasury said in a statement issued on March 2, 2025.

The Federal government has now decided it will no longer enforce the requirements for most businesses in Southwest New Mexico and throughout the United States to file Beneficial Ownership Information (BOI) reports.

- Category: The Chronicles of Grant County

The Chronicles Of Grant County

New Federal Reporting Requirements

Now Mandatory – Again

Part Five

(The image was provided courtesy of the United States Department of the Treasury.)

(The image was provided courtesy of the United States Department of the Treasury.)

(The image was provided courtesy of the United States Department of the Treasury.)

It’s back.

The requirement for most businesses in Southwest New Mexico and throughout the United States to file ownership details and personal information with the United States Department of the Treasury is back.

The new deadline for businesses to provide the information to the Federal government is March 21, 2025.

- Category: The Chronicles of Grant County

The Chronicles Of Grant County

New Federal Reporting Requirements

Now Mandatory – Again

Part Five

(The image was provided courtesy of the United States Department of the Treasury.)

(The image was provided courtesy of the United States Department of the Treasury.)

It's back.

The requirement for most businesses in Southwest New Mexico and throughout the United States to file ownership details and personal information with the United States Department of the Treasury is back.

The new deadline for businesses to provide the information to the Federal government is March 21, 2025.

- Category: The Chronicles of Grant County

The Chronicles Of Grant County

Foreign Ownership Of Agricultural Land In Southwest New Mexico

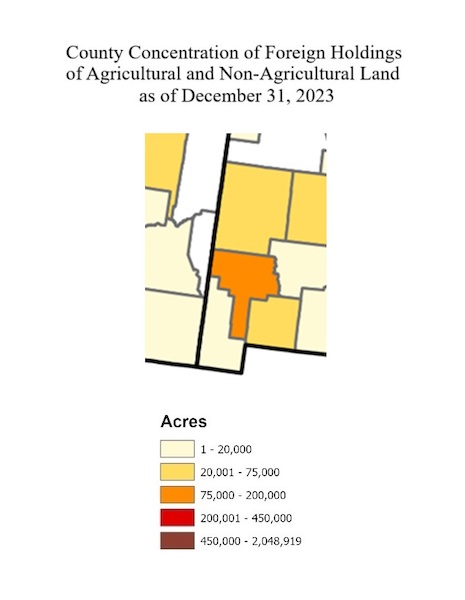

This map shows the amounts of acreage owned by foreign entities and individuals in Southwest New Mexico and surrounding areas. Grant County is highlighted in a darker shade of orange on this map. (The map was provided courtesy of the United States Department of Agriculture, December 31, 2023.).

This map shows the amounts of acreage owned by foreign entities and individuals in Southwest New Mexico and surrounding areas. Grant County is highlighted in a darker shade of orange on this map. (The map was provided courtesy of the United States Department of Agriculture, December 31, 2023.).

More than 161,000 acres in Southwest New Mexico are owned by individuals and entities from 9 other nations.

These statistics are from a report issued by the Farm Service Agency of the United States Department of Agriculture (USDA), “Foreign Holdings of United States Agricultural Land Through December 31, 2023”, as well as the detailed data underlying the annual reports of the Agricultural Foreign Investment Disclosure Act (AFIDA). This report and its detailed data include the most recent information on this subject from the USDA.

As noted in The Chronicles Of Grant County in 2024, the data utilized by the USDA as of December 31, 2021, included information that may not be correct.

The USDA included that same information in the updated data as of December 31, 2023.

- Category: The Chronicles of Grant County

The Chronicles Of Grant County

Agriculture In Catron County

There were 305 farms operating in Catron County in 2022. (The map was provided courtesy of the United States Department of Agriculture, 2024.)

There were 305 farms operating in Catron County in 2022. (The map was provided courtesy of the United States Department of Agriculture, 2024.)

While there was an 11% decrease in the number of farms in Catron County during the five years from 2017 to 2022, there was also a steady increase in the amount of acreage used for agricultural purposes in Catron County during that same time period.

In 2022, there were 305 farms in Catron County. This was a decrease in the number of farms from 2017 when there were 341 farms in the county. The number of farms in 2017 was 3% less than the number of farms in 2012 in Catron County.

- Category: The Chronicles of Grant County

The Chronicles Of Grant County

Nickel Street

In Deming And Lordsburg

Despite its name, the nickel coin is mostly composed of copper. (The image was provided courtesy of the United States Mint, 2024.)

Despite its name, the nickel coin is mostly composed of copper. (The image was provided courtesy of the United States Mint, 2024.)

Nickel Street in Lordsburg and a roadway with the same name in Deming are both named after the metal.

"Nickel is primarily sold for first use as refined metal (cathode, powder, briquet, etc.) or ferronickel," according to a statement from the United States Geological Survey (USGS). "About 65% of the nickel consumed in the Western World is used to make austenitic stainless steel. Another 12% goes into superalloys…or nonferrous alloys. Both families of alloys are widely used because of their corrosion resistance."

- Category: The Chronicles of Grant County

The Chronicles Of Grant County

Updates On Tax Form 1099-K For 2025

Changes are coming for people who received income through third-party settlement organizations in 2024. (The image was provided courtesy of the IRS.)

Changes are coming for people who received income through third-party settlement organizations in 2024. (The image was provided courtesy of the IRS.)

The Internal Revenue Service (IRS) will be provided with more complete information about income earned by people who utilized third-party settlement organizations in 2024.

If someone received $5,000 or more through third-party settlement organizations during Year 2024, they will be receiving a Form 1099-K detailing those payments. That Form 1099-K is to be sent to them in early 2025. The IRS will also get a copy of their Form 1099-K in early 2025.

- Category: The Chronicles of Grant County

The Chronicles Of Grant County

Federal Tax Credits For Farmers And Ranchers Using Fuel For Agricultural Purposes

The IRS offers information on Federal tax credits available to farmers and ranchers that use fuel off-the-highway for agricultural purposes. (The logo was provided courtesy of the IRS.)Farmers and ranchers in Catron, Grant, Hidalgo, and Grant Counties have the ability to seek tax credits if they have used fuel for agricultural purposes at their farms and ranches.

The IRS offers information on Federal tax credits available to farmers and ranchers that use fuel off-the-highway for agricultural purposes. (The logo was provided courtesy of the IRS.)Farmers and ranchers in Catron, Grant, Hidalgo, and Grant Counties have the ability to seek tax credits if they have used fuel for agricultural purposes at their farms and ranches.

The amounts of the credits could be modest or could be considerable, depending on the type and the amount of fuel used for farming or ranching operations.

Each time someone purchases a gallon of gasoline, for example, the price paid includes a Federal fuel tax. These taxes have been assessed for the purpose of highway construction, maintenance, and repair.

Content on the Beat

WARNING: All articles and photos with a byline or photo credit are copyrighted to the author or photographer. You may not use any information found within the articles without asking permission AND giving attribution to the source. Photos can be requested and may incur a nominal fee for use personally or commercially.

Disclaimer: If you find errors in articles not written by the Beat team but sent to us from other content providers, please contact the writer, not the Beat. For example, obituaries are always provided by the funeral home or a family member. We can fix errors, but please give details on where the error is so we can find it. News releases from government and non-profit entities are posted generally without change, except for legal notices, which incur a small charge.

NOTE: If an article does not have a byline, it was written by someone not affiliated with the Beat and then sent to the Beat for posting.

Images: We have received complaints about large images blocking parts of other articles. If you encounter this problem, click on the title of the article you want to read and it will take you to that article's page, which shows only that article without any intruders.

New Columnists: The Beat continues to bring you new columnists. And check out the old faithfuls who continue to provide content.

Newsletter: If you opt in to the Join GCB Three Times Weekly Updates option above this to the right, you will be subscribed to email notifications with links to recently posted articles.

Editor's Notes

It has come to this editor's attention that people are sending information to the Grant County Beat Facebook page. Please be aware that the editor does not regularly monitor the page. If you have items you want to send to the editor, please send them to editor@grantcountybeat.com. Thanks!

Here for YOU: Consider the Beat your DAILY newspaper for up-to-date information about Grant County. It's at your fingertips! One Click to Local News. Thanks for your support for and your readership of Grant County's online news source—www.grantcountybeat.com

Feel free to notify editor@grantcountybeat.com if you notice any technical problems on the site. Your convenience is my desire for the Beat. The Beat totally appreciates its readers and subscribers!

Compliance: Because you are an esteemed member of The Grant County Beat readership, be assured that we at the Beat continue to do everything we can to be in full compliance with GDPR and pertinent US law, so that the information you have chosen to give to us cannot be compromised.

Submitting to the Beat

Those new to providing news releases to the Beat are asked to please check out submission guidelines at https://www.grantcountybeat.com/about/submissions. They are for your information to make life easier on the readers, as well as for the editor.

Advertising: Don't forget to tell advertisers that you saw their ads on the Beat.

Classifieds: We have changed Classifieds to a simpler option. Check periodically to see if any new ones have popped up. Send your information to editor@grantcountybeat.com and we will post it as soon as we can. Instructions and prices are on the page.